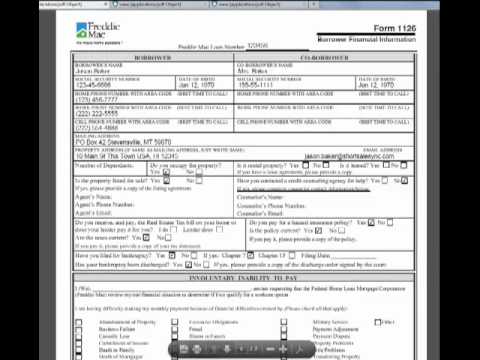

In this training segment, we're going to show you how Short Sale Sync saves you even more time by filling out Form 1126 and Form 710. Anyone who is currently doing short sales, especially with Bank of America or Anna Fannie and Freddie product, knows that the bank, for whatever reason, Bank of America is still asking for the 1126 form even though that form has been replaced by the 710 form. We just want to show you that Short Sales Inc. has both forms and where to find them. So, if they ask you for a Form 1126, another word for that is the Freddie Mac Short Sale Application. You can find it right here, simply drag that over. What you're going to find is after you send these forms in, the bank is just going to ask you to redo it in many cases and they're going to be asking you for something called the Uniform Borrowers Assistance Form. You'll find that under standardized forms here, drag that over. So, a good idea is to send both into the bank. If they're asking you for one or the other, the system will auto-populate the entire applications. Let's take a look. As you can see, the Form 1126 or Freddie Mac Form 1126 is fully populated, from the name to the address to the phone numbers. The only thing they're going to need to fill in is their hardship line and involuntary ability to pay section. It even puts in junior lien holders as well as income announces. The next form that it auto-populates is the Form 710 of the Uniform Borrower System. So, this saves you two hours an hour. If you need this form again, you can find it on the left-hand side under standardized forms, drag...

Award-winning PDF software

Universal 710 october 2021-2025 Form: What You Should Know

Publication 3319 — Low-Income Taxpayer Clinic Grant Summary Publication 3319 — Low-Income Taxpayer Clinic Grant Application Summary. Publication 3319 ITC HELP FOR TAXPAYER ADVOCATE SERVICE Representation • Education • Advocacy 2025 GRANT APPLICATION PACKAGES AND REFERENCE DOCUMENTS 2025 GRANT AGREEMENTS: The Internal Revenue Service is requesting proposals for grant applications. Grants will only be awarded for organizations that meet the following criteria: In order to ensure the effectiveness of all grantees, the IRS will be requiring that each grant application include a detailed description of the organization's proposed activities and a description of the organization's ability to administer and implement the proposed activities; All grantees must agree to the following: that they will implement the proposed activities described in their grant application; and All grantees must agree to the requirement that the IRS may make limited exceptions to this requirement. ITC Helps FOR PUBLIC SERVICE EMPLOYEES Representation • Education • Advocacy 2025 GRANT APPLICATION PACKAGES AND RATINGS The Internal Revenue Code specifies several special rules for public service agencies. They include the following: If your organization is an educational, non-profit public service agency, you may make up to 8.5% of the total budget of your organization for grants. It is not necessary or recommended that an organization's budget be under 35 million. The IRS recognizes that tax-exempt organizations often need to raise additional revenue to fund their programs and service operations. The IRS also recognizes that many public service organizations are small and may often have financial difficulties in fulfilling the requirements for a tax-exempt status. In addition, many public service organizations must work to ensure that a substantial portion of their non-cash resources are invested in the operation of their programs and services. These requirements mean that some of your organization's activities will not be tax-deductible. The IRS has designated two rating scales to measure the fiscal management and business planning practices of public service organizations. The “Public Service Fund” is a general-purpose, one-year, unrestricted award to a public service organization. The “Financial Management Guidelines” are intended for organizations that meet the general-purpose, non-profit definition. They have two types of ratings: Financial Management Guidelines for Non-Profit Organizations and for Tax-Exempt Organizations (Form I-601).

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Freddie Mac / Fannie Mae 710, steer clear of blunders along with furnish it in a timely manner:

How to complete any Freddie Mac / Fannie Mae 710 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Freddie Mac / Fannie Mae 710 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Freddie Mac / Fannie Mae 710 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Universal Form 710 october 2021-2025