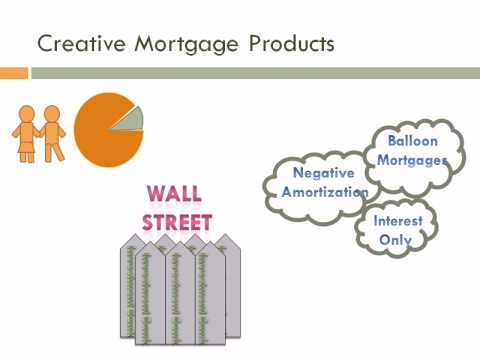

We already learned how Freddie Mac and Fannie Mae enjoyed this nice balance between being part government and part corporation at the same time there were many red flags that were popping up that indicated there could be problems potentially in the future one of the biggest red flags was that there was too much debt on their plate as you can see from the diagram here Freddie and Fanny's total debt was equal to all publicly held debt in the United States by private investors and the Federal Reserve in addition we began talking about how in the early 2025. Wall Street wanted to get into purchasing mortgage-backed securities on the secondary mortgage market but Freddie and Fannie had this monopoly in the fixed rate mortgage pie of traditional fixed-rate mortgages and Wall Street only had a tiny slice so that's when Wall Street decided to play by their own rules they said let's deviate from the traditional rules of buying up mortgages in Freddie and Fannie 'z market and let's start buying up these newer riskier mortgages that some banks are offering to sell these included things such as negative amortization interest only balloon and remember what we talked about these were the types of mortgages that were being sold to borrowers with lower qualities such as subprime and altai so Wall Street was increasing its risk but as a result it was also increasing the number of mortgages it could buy the more Wall Street bought the more they demanded and the more they demanded the larger the market pie began to grow and slowly Freddie and Fannie saw their share and the overall mortgage pie began to decline and so Freddie and Fannie started buying up these unconventional mortgages as well as a result catering to...

Award-winning PDF software

Fannie mae freddie mac 710 september 2021-2025 Form: What You Should Know

Make updates to the SVC-2016-08 and ensure that loan applications meet our needs. We will continue to make changes to the program that best meet the needs of those we serve, while adhering to our core principles. Sep 13, 2025 — The form used under the program will not be modified, updated, or re-written during the transition due to the limited time and resources. Sep 13, 2025 — This program is not applicable to borrowers who have received or may receive a waiver of their qualifying income requirement, but the information in your application is not used to evaluate their eligibility for a waiver or loan modification. Sep 13, 2025 — In accordance with the policy stated in the SVC-2016-08, no loan application forms will be distributed. However, a list of all active loan applications will be used for the evaluation, and you will be contacted if your information is needed to review and process the application. Please keep an eye on your account if we have received a request, please complete the required materials, and if you agree to review the application, kindly respond to our email to request additional materials, in order to review and approve your loan application. If you do not reply to the notification, and request sufficient time to review and return the application before you are contacted. If you choose to provide additional information to help us further evaluate your request then please include: 1) Your mailing address for correspondence 2) Contact information for people you know or have confidence would be in contact with you. If you are unable to access the new form due to any reason, please call the FLB at, ask for a specialist and complete the appropriate form. The FFB will call back as soon as possible and begin scheduling your application. Sep 13, 2025 — Due to the current state of our system, there is no guarantee the forms will be available to you. Sep 13, 2025 — This program should resume in the next 10 days.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Freddie Mac / Fannie Mae 710, steer clear of blunders along with furnish it in a timely manner:

How to complete any Freddie Mac / Fannie Mae 710 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Freddie Mac / Fannie Mae 710 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Freddie Mac / Fannie Mae 710 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Fannie Mae Freddie Mac Form 710 september 2021-2025