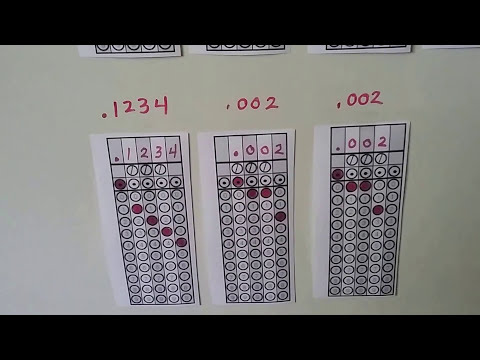

We're going to discuss writing answers into the answer sheet in this lesson 3c. Alright, I know you're thinking, "Come on, just fill in the little oval, the little bubble." And that's true, but there's actually more to it when the answer is a fraction or decimal. It gets tricky, so I want you to remember that rows go across and columns go up and down. You'll thank me for that when you get into algebra and matrices and all that stuff. So rows go across, columns go up and down. These rows are for the fraction bar and the decimal point. We need these, okay? This is where we actually write in the answer on the top, and some of the answers will not be multiple choice. We'll have to write in and bubble the answer. These answer grids are intended for one answer each, so you'll have an entire grid like this for only one answer, and the row at the top is where we write in the numbers. You can actually leave it blank, but if you use it, you'll have a guide to filling in these bubbles, okay? It'll be easier on your eyes, and your answer can start in any column, as long as the answer is complete, and any unused column should be left blank. So we could start here to write 12. We could start here, here, or here, as long as we have enough room to put two digits, and then these would be left blank, see? Whichever column we didn't use. So I'll show you if the answer is a whole number, and we know what that is. Now, if you've been watching these GED videos in this playlist, it's a counting number. It's no fractions or decimals allowed. So if...

Award-winning PDF software

Standard 710 Form: What You Should Know

For more information on the application process, see our page: Applications and Processing, Form 710. The following is a review to the guidance on a specific application. Some issues raised in the above links are covered in the links provided below. Bonded Mortgage. Bonded Mortgage is the process used by most new homebuyers seeking to refinance. The loan is secured by both the home and the first 50,000 of the down payment of the mortgage, in most cases. The borrowers have a legal requirement to prepay any remaining home payment with the first 50,000 down payment. The bond (the actual mortgage) is paid off every month on a scheduled date after the first 50,000 down payment. Bonded Mortgage is not suitable for all home purchase types. Please visit this link to the USA site for more information. The term for which the first 50,000 in down payment and closing costs are paid will depend on how much mortgage you have. Most lenders require the first 50,000 in the first year of a 5 or 15-year loan. Some lenders consider the first 50,000 in a 30 day or 6-year loan to be in the “new”, and require that payment be paid in full annually, instead of monthly. The term of the loan may also depend on whether the borrower refinances their mortgage, or uses a reverse mortgage. It is important to understand that a person who refinances their existing mortgage by borrowing for the down payment of a new loan would not be required to make any down payment on the new loan. The only difference would be that, the loan balance would go from the old outstanding balance to this amount, and the payments would occur on a quarterly basis instead of monthly. The down payment and closing costs on the new mortgage would be paid in full each month, as long as it is on a quarterly basis. Bonded mortgages are often considered by some to be an inferior version of the home purchase as a whole. It would normally be considered necessary to have secured credit, but is not necessary to have a loan that is secured by the first 50,000 in the down payment. It is not an alternative to a 20-year fixed rate mortgage or an 80/20 fixed rate mortgage. A similar loan can be secured by a cash value on a land contract.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Freddie Mac / Fannie Mae 710, steer clear of blunders along with furnish it in a timely manner:

How to complete any Freddie Mac / Fannie Mae 710 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Freddie Mac / Fannie Mae 710 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Freddie Mac / Fannie Mae 710 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Standard Form 710